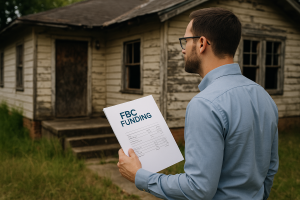

Advantages of FBC Funding for Fix and Flip and BRRRR

The Advantages of FBC Funding for Fix-and-Flip and BRRRR Investors

Real estate investors generally consider three paths when funding projects: FBC Funding, self-funding, or the ever-bureaucratic conventional FNMA loan. Each has its merits, but when speed, scalability, flexibility, and execution matter—as they always do in fix-and-flip or BRRRR investing—FBC Funding quietly becomes the partner who actually shows up, toolbox in hand, ready to work. The Advantages of FBC Funding for real estate investors include: speed, flexibility, scalability, programs designed for investors and certainty. Based on FBC Funding’s experience they also offer a consultative approach to help investors understand good deals according to their goals.

The Advantages of FBC Funding - Speed: The Critical Advantage

FBC Funding is built for velocity. While conventional financing often moves at the pace of a committee meeting, FBC Funding can close in days—not weeks. In competitive markets, that speed isn’t just convenient; it wins deals. Distressed sellers prefer certainty, and investors need to act fast. Self-funding is only faster if you have six figures in cash conveniently lounging in your bank account—most don’t. But if you are looking to scale self funding holds you back.

The Advantages of FBC Funding -Flexibility: Real-World Deals Require It

Conventional FNMA loans love clean, picture-perfect homes. A distressed property? Missing kitchen? Structural issues? FNMA politely declines.

FBC Funding, however, leans in. Decisions are based on the asset and after-repair value (ARV), not cosmetic flaws or underwriting gymnastics. This creates a clear advantage for BRRRR investors who need acquisition and rehab financing before refinancing into long-term DSCR or conventional loans. Self-funding offers freedom too, but empties your liquidity in the process—never an investor’s favorite pastime.

The Advantages of FBC Funding – Leverage: Scale Without Draining Cash

Self-funding limits growth. Every dollar tied up in one project can’t be deployed into the next. FBC Funding preserves your cash, enabling multiple projects simultaneously. Even with higher interest costs, investors often earn better returns on equity because they use far less of their own capital. FNMA loans provide attractive rates, but only for move-in-ready homes and borrowers who check every box—not exactly ideal for aggressive scaling.

The Advantages of FBC Funding – Rehab-Ready Structure: Designed for Investors

FBC Funding typically finances both the purchase and renovation, often based on a percentage of ARV. This structure creates predictable draw schedules and smooth project flow. FNMA loans rarely offer renovation funding without layers of paperwork and delays. Self-funding handles rehab cleanly, sure—but watching $60,000 vanish from a checking account can be… educational.

The Advantages of FBC Funding – Certainty: The Ultimate Investor Advantage

In real estate, reliability is a competitive edge. FBC Funding provides clear terms up front, closes consistently, and understands investor timelines. FNMA lenders often add conditions or eleventh-hour surprises. Self-funding avoids underwriting, but demands a level of liquidity most investors prefer to put to work—not park.

The Advantages of FBC Funding – Conclusion

FBC Funding gives fix-and-flip and BRRRR investors what they truly need: speed, flexibility, leverage, and certainty. While self-funding offers autonomy and FNMA loans offer low rates, only FBC Funding is engineered for real-world investing, where opportunities are fast, properties are imperfect, and timing decides profit.