Advantages of 100% Fix and Flip Financing for Experienced Investors

Advantages of 100% Fix and Flip Financing for Experienced Investors

For seasoned real estate investors, leverage is more than a tool—it’s a competitive advantage. And while many investors have the liquidity to put 10%, 20%, or even 30% down, there is an undeniable appeal in financing that covers 100% of purchase and rehab costs. It’s the real estate equivalent of ordering dessert without checking the calories: you know you could pay, but it’s far more satisfying when you don’t have to.

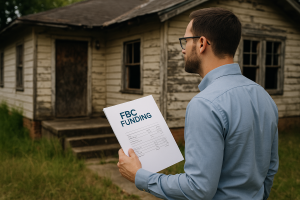

Below are the core benefits of 100% fix-and-flip financing with FBC Funding and why experienced investors consider it one of the most strategic forms of capital in today’s market.

Advantages of 100% Fix and Flip Financing : Preserves Your Liquidity for Smarter Moves

Even investors with strong cash positions know the true value of liquidity. When FBC Funding covers the full acquisition and rehab budget, your capital stays where it belongs—available. Having cash on hand means you’re ready for unexpected opportunities, competitive offers, and those irresistible off-market deals that never wait politely.

Advantages of 100% Fix and Flip Financing: Multiply Your Deal Flow Without Stressing Your Wallet

If you can fund one flip with your own money, great. But if financing covers 100% of the costs, that same liquidity can support two, three, or even four projects at once. Portfolio expansion becomes less of a dream and more of a well-organized construction schedule—minus the contractor who “forgot” to show up.

Advantages of 100% Fix and Flip Financing: Higher ROI Through Efficient Leverage

By contributing minimal or no capital to the project, the percentage return on your invested dollars increases significantly. Investors often joke that the only thing better than a strong ROI is an ROI calculated on almost no out-of-pocket funds. With FBC Funding, the math is firmly on your side.

Advantages of 100% Fix and Flip Financing: Faster Deployments and Quicker Market Advantage

100% financing typically comes from lenders like FBC Funding who understand real estate investing, renovation timelines, and speed. Experienced investors benefit from quicker approvals, smoother underwriting, and less paperwork than traditional financing—allowing you to move fast in a market where delays can be as costly as a busted water line.

Advantages of 100% Fix and Flip Financing: Ideal for Experienced Investors with Cash Reserves

This financing structure is specifically designed for investors who could put money down but prefer not to. FBC Funding feels confident because you’ve demonstrated experience, and you retain the liquidity to backstop the project if needed. Everyone sleeps better—especially you.

Advantages of 100% Fix and Flip Financing: Ability to Pursue Larger or Higher-Margin Projects

When funding from FBC Funding includes the full purchase plus rehab budget, investors can step confidently into more ambitious deals. Larger properties, heavier rehabs, and higher-profit opportunities suddenly become well within reach. Think of it as graduating from cosmetic flips to projects that actually require a hard hat.

Advantages of 100% Fix and Flip Financing: Strengthens Negotiation Power with Sellers

Cash-equivalent offers backed by 100% financing from FBC Funding can compete in environments where speed and certainty matter most. When sellers know you can close quickly they tend to take your offer a bit more seriously—and occasionally even smile.

Advantages of 100% Fix and Flip Financing: Conclusion

For experienced investors with solid liquidity, 100% fix and flip financing from Funding offers a powerful combination of flexibility, scalability, and efficiency. It preserves capital, accelerates growth, and enhances ROI—all while giving you the freedom to pursue more deals with less personal financial strain.

To Get more information or prequalified call today at 888-848-3114 or

Click here to schedule a free loan consultation